(Bloomberg) — The price of options that protect against an extended slump in Treasuries is soaring as traders brace for a bevy of decisive events in the weeks ahead that have the potential to deepen the market’s losses.

Most Read from Bloomberg

Hedging is ramping before the release of a key batch of payrolls data next week, followed by the US election Nov. 5 and the Federal Reserve’s next policy announcement two days later. Benchmark 10-year rates touched the highest since July on Tuesday, but as traders see it now, the risk is for an even bigger jump in yields.

The bond market is reacting to signs of a resilient US economy, which is leading them to trim bets on the scope of Federal Reserve interest-rate cuts over the next 12 months. But investors are also hedging against a scenario where the election produces a unified Republican government that fuels quicker growth and inflation, matched with wider federal deficits and added Treasury supply.

In the Treasury options market, that backdrop is being reflected in the price of puts that protect against higher yields relative to that of calls hedging against lower yields. That skew in favor of puts is close to the most extreme levels this year.

A couple Treasuries options trades seen this week drive home the bearish tone. On Tuesday, one position targeted an increase in 10-year yields to roughly 4.75% within a month — the highest since April — from 4.2% now. On Monday, there was similar demand seen for options targeting a selloff in longer maturities.

The latest jump in yields has drawn added fuel from deleveraging in the futures market, which has also pushed the yield curve steeper. Open interest, a measure of new positioning held by investors, has dropped in 12 of the past 14 sessions in the 10-year contract — a signal that unwinding of long positions has fed into higher cash yields.

Here’s a rundown of the latest positioning indicators across the rates market:

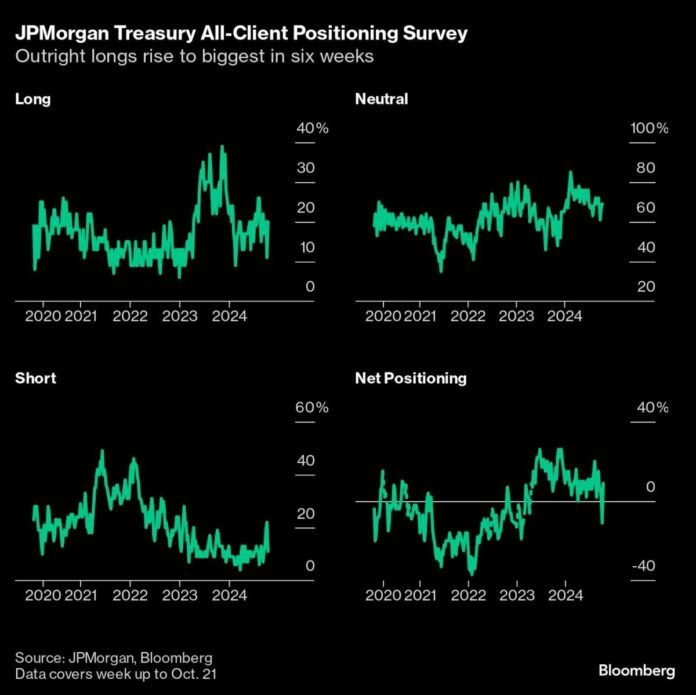

JPMorgan Survey

In the week through Oct. 21, JPMorgan Chase & Co.’s survey of clients’ Treasury positions showed an increase for both outright long and short positions, with neutrals dropping 6 percentage points on the week. The number of shorts rose 4 percentage points to one of the highest readings this year, while outright longs rose 2 percentage points to the biggest in six weeks.