MUMBAI: The current year has been a blockbuster for initial public offerings.

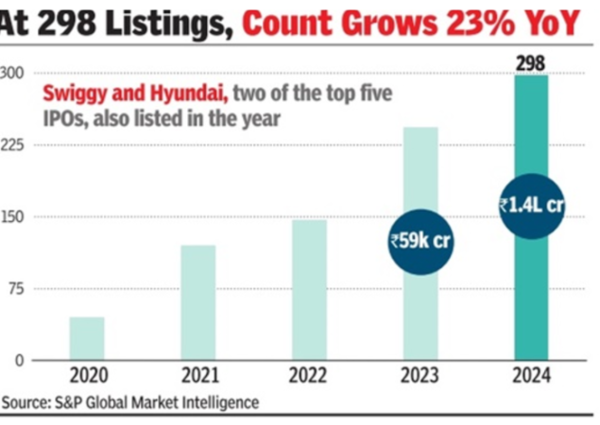

A total of 298 companies have listed on the stock exchanges, raising a combined Rs 1.4 lakh crore — a 139% increase over the Rs 58,827 crore raised in 2023. The previous best was in FY22 when a total of Rs 1.3 lakh crore was raised via equity sales, the highest in the last 35 years based on numbers from PRIME Database Group, a capital markets data provider. The total number of companies that have gone public during the year is 22.6% more than the previous year.

Moreover, 2025 is expected to be a blockbuster year too given the number of offerings in the pipeline, an S&P Global Market Intelligence report said. The research unit of the global ratings agency said that this is be cause of economic growth which, coupled with favourable market conditions and an improvement in regulatory frameworks, helped achieve these new records.

The current fiscal also saw two of the top five IPOs: Hyundai Motors’ Rs 27,859 crore OFS and Swiggy’s Rs 11,327 crore issue. Both companies traded at premium after listing.

Ramdeo Agrawal, chairman at Motilal Oswal Financial Services, said, “Looking at the line up of offerings, there’s no doubt that the supply is there. Now, it depends on the absorption capacity of the market which will get tested.”

According to Dharmesh Mehta, MD & CEO at DAM Capital, domestic investor demand for Indian equity will be a constant and FPIs too will return to Indian markets in FY26. The new supply in 2025 is expected to come from some giant companies like LG India, Jio Telecom, HDB Finance and Tata Capital. “Supply brings its own demand. If there is equity supply from a good company, there will be demand irrespective of market conditions. Prime example of this is Hyundai,” Mehta said.

He added that the key to demand is valuation. “If there is any bad news on the economy, the valuation of IPOs will factor in that. The demand is not going away. The change in mindset from savings to equities is a longterm change and not a shortterm one. I would say that if valuations improve (due to price correction), the demand for equities is likely to increase,” he said.