Multiple nominees for Fixed Deposits soon? The Parliament’s winter session, commencing today, is expected to consider legislation amending banking regulations to enable depositors to designate multiple nominees for fixed despots with specified shares.

The implementation of comprehensive multiple nomination arrangements could benefit numerous middle-class families who possess wills and maintain substantial bank fixed deposits.

Currently, many depositors fail to designate nominees when opening fixed deposits, possibly due to insufficient awareness.

The Covid pandemic exposed a critical financial challenge when bereaved families struggled to access and distribute funds from fixed deposits following the death of primary earners who held sole accounts.

Since the onset of the pandemic, banks have actively encouraged customers via electronic communications to register nominations for at least one deposit account or safe deposit locker.

Fixed Deposit Nominees: What are the proposed new rules?

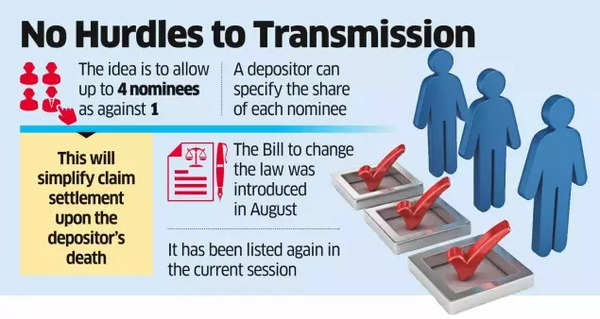

- According to an ET report, the proposed modifications would permit up to four nominees, compared to the current single nominee system.

- The arrangement could follow either a ‘simultaneous nomination’ format, specifying percentage shares for nominees, or a ‘successive nomination’ structure, where subsequent nominees become effective upon the death of preceding ones.

- In simultaneous nomination cases, following the account holder’s death, nominees can access funds according to their predetermined shares as specified by the depositor. This system aims to facilitate smoother claim settlements and fund distributions to rightful heirs.

FD Nomination

The concept of streamlining joint ownership and nomination rules for financial assets was initially proposed by Pramod Rao, currently SEBI execution director, in his publication during his tenure at ICICI Bank.

Also Read | PPF Calculator: How to become a crorepati with Public Provident Fund? Explained

Recent consultations by the finance ministry with the banking sector revealed diverse opinions. A banking professional noted that effective implementation would require nominees to be informed of their shares and actively engage with banks.

According to banking law specialist and former banker Rajeev Dewal, the proposed amendment aims to simplify matters for families following the death of the primary account holder.

“However, it would be simplistic to believe that such a move would eliminate all complications. Even while a multiple nomination option is offered, one should keep in mind a few points. First, nomination in any case is not legal succession of the account holder but a mechanism for quicker disposal of deposit/ contents of locker or safe custody. Second, multiple nominees may also create a room for disputes among them thereby delaying the disposal. Lastly, since a bank must split a deposit into multiple parts for distributing the amounts as per the shares, there may be non-reconciliation, unclaimed deposits and even frauds when a nominee dies or does not claim her share,” he told ET.

Also Read | Top 5 Bank Fixed Deposits: Which are the best FDs for 1, 2, 3 and 5-year time period? Check list

Anup P Shah from CA firm Pravin P Shah & Company suggests aligning the beneficiaries named in the will with the multiple nominees to prevent potential disputes and legal complications. He notes that similar provisions exist for other investments, such as mutual fund units. The securities market has established procedures allowing nominees to contact asset management companies, which then communicate with other intermediaries using the deceased investor’s permanent account number (PAN).

“For banks there could be identifiers other than the PAN. However, if a similar system can be replicated for bank deposits, it would benefit many as bank deposits are still a large part of household savings,” said an industry official. Bank deposits’ proportion in total household savings has declined from over 55% to below 40% during the past ten years.