Better Domestic Macro Indicators Also Contribute To Rally

MUMBAI : Equity markets rebounded on Tuesday, with sensex gaining 1,131 points and Nifty 50 rising 325 points as investors bought beatendown stocks, betting that the market has bottomed out.

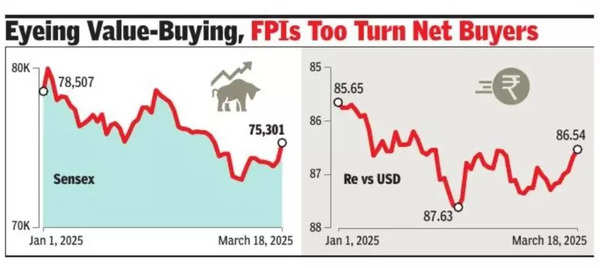

The Nifty 50 recovered to 22,834, signalling a key inflection point, while short-covering added to the momentum. Foreign institutional investors (FIIs) were net buyers, acquiring shares worth Rs 1,463 crore. FIIs purchased stocks worth Rs 15,450 crore and sold Rs 13,987 crore, while domestic institutional investors bought equities of Rs 11,686 crore and offloaded Rs 9,658 crore. The sensex closed 1.5% higher at 75,301, while Nifty 50 gained 1.5%.

The rupee strengthened 0.3% to 86.57, up 23 paise from its previous close of 86.80 against the US dollar as the greenback continued to weaken against major currencies. The 10-year govt bond yield declined two basis points after the RBI repurchased bonds to infuse liquidity.

.

The equities rally was part of a global upswing in indices, which began with the US markets on Monday and led Asian markets to open in the positive zone and led to rally in European equities towards late afternoon.

“As markets were in a bearish mode over the past few weeks and valuations had become a bit attractive, investors seized opportunity in the beaten-down sectors. But the recovery would be difficult to hold on due to global challenges,” said Prashant Tapse, senior VP, Mehta Equities.

Domestic factors also contributed to the rally. India’s improving macro economic indicators, including a reduced trade deficit, rising GDP growth, and higher tax collections, supported sentiment. Lower crude prices added to positive outlook, while proactive engagement with the US on tariff concerns reassured investors. Financial stocks rebounded after recent losses, and rising base metal prices lifted steel makers. Investors engaged in bargain buying, taking advantage of lower valuations in beaten-down sectors.